Travel Expense Reimbursements

Policy 2020 prescribes the manner in which the District reimburses directors and employees for reimbursements of expenses related to District business, or attendance to training sessions and conferences.

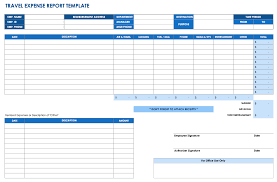

Per Section 53065.5 of the State of California Government Code, each special district, as defined by subdivision (a) of Section 56036, shall, at least annually, disclose any reimbursement paid by the district within the immediately preceding fiscal year of at least one hundred dollars ($100) for each individual charge for services or product received. “Individual charge” includes, but is not limited to, one meal, lodging for one day, transportation, or a registration fee paid to any employee or member of the governing body of the district. The disclosure requirement shall be fulfilled by including the reimbursement information in a document published or printed at least annually by a date determined by that district and shall be made available for public inspection. SPMUD has chosen to publish the most recent personnel expense reports for reimbursements to Directors or Employees for business-related travel.

E Costan CALPELRA Conference November 2025E Costan CSDA Board Secretary Conference October 2025E Nielsen Placer Business Alliance DC Summit October 2025E Nielsen CSDA GM Summit June 2025A Moore CWEA Safety Day May 2025A Roeh SHRM Legislative HR Summit April 2025C Huff CWEA P3S Conference February 2025A Moore CWEA P3S Conference February 2025J Roston CWEA P3S Conference February 2025E Costan CalPELRA Conference November 2024H Niederberger CSDA Annual Conference September 2024H Niederberger CSDA GM Summit June 2024E Nielsen WEF Conference February 2024